With this blog post we would like to give you some impression on the Sale & Lease Back (SLB) options the majority of operators and even some engine owners are performing in order to gain liquidity.

Sale and Lease Back - Option for Liquidity?

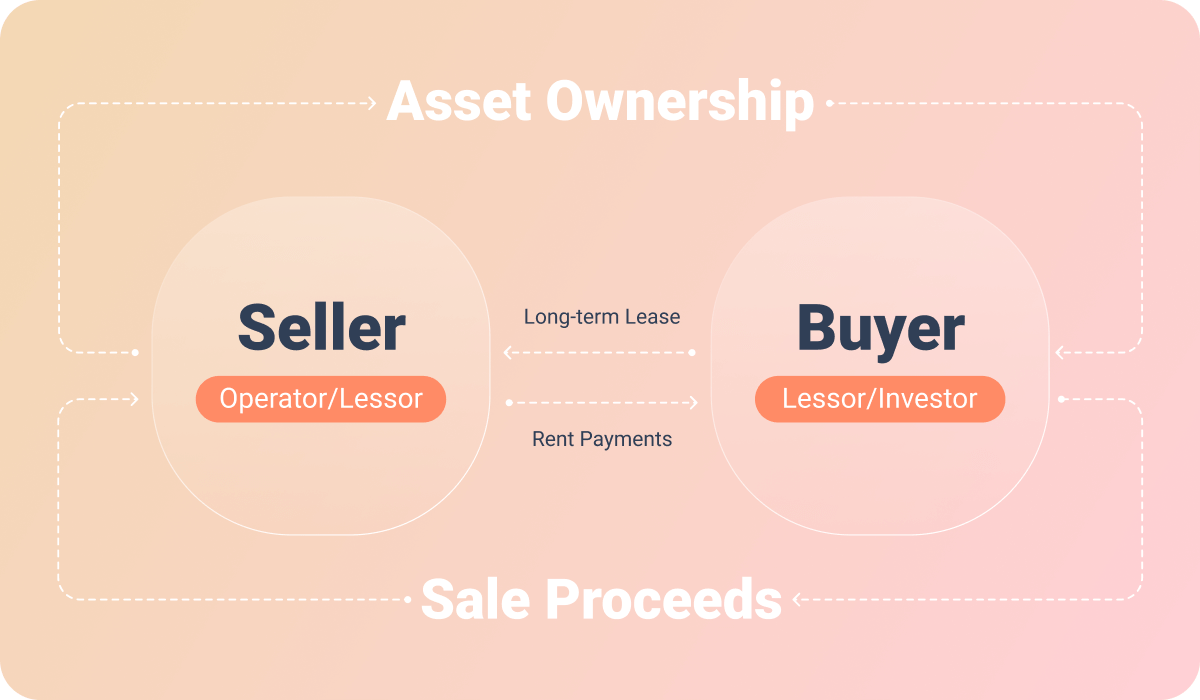

As already known a SLB is a financial transaction in which the engine owner sells his asset but leases it back for the long term from the new owner immediately. The seller will be able to use the asset but no longer owns it. It is common that there is only a transfer of ownership but no physical transfer of the asset. In other words the SLB transactions are an effective way to unlock capital which is initially blocked as equity. Most likely performed by operators, the SLB was also used by several lessors during the ongoing Covid19 pandemic. Hence a SLB transactions represent a moderate and simple way for an engine owner to quickly increase the own cash reserves. It is to mention that leased assets are more expensive in the long run than owned ones. However, they provide several advantages to outright purchases, including flexibility, quicker access to modern aircraft and engine types and lower initial capital outlay.

Is there an increase of Sale and Lease Back activities during the pandemic?

Before the above question can be answered we need to take a closer look into the financial strategies of airlines and lessors regarding cash burn and liquidity. These aspects were discussed in excellent panels during this weeks Airfinance Journals 'The Dublin Dialogue'.

Airlines

A lot of airlines were down rated by rating agencies throughout 2020 and the outlook for this year does not look brilliant at all. A lot of operators show aircraft utilization at 50-60% compared to 2019 and some operators still struggle with utilization rates as down as 20%. Despite the huge bailouts and other governmental support the majority of operators will have to provide viable and robust strategies for the years of recovery in order to finance their business and complete clean balance sheets.

During one of the panels at 'The Dublin Dialogue' a case study to the question about most successful cash-burn and liquidity management strategies was held with American Airlines and Finnair.

As described by the respective representative, American Airlines was able to complete a viable and solid balance sheet for 2021 with all of the returns secured and financed for this year already. The level of financing required, surpassed the usual amounts by far with $14 billion. American used a mix of different instruments and sources to complete this almost back-breaking task. The team focused on a variety of tools to take down the cost structure :

- Accelerated retirements and restructuring the fleet to prepare for the future

- Network optimization through a complete tear down and build up from scratch focusing on connectivity with new hubs

- Labor reductions

- Focusing on key services and products

- Optimization of maintenance activities

The strategies of Finnair were quite similar. The team followed the 'No fly, no pay' principles to keep the variable costs down. Also the support from the government by providing financial aids to the furloughed labor with the security to get the employees back once the demand and operations recover, were a great contributor. Furthermore network reduction was seen as a required tool with the current network already reduced to the minimum.

Maintenance optimisations and cost reductions through deferrals were mentioned by both representatives of the carriers and especially the asset liquidation was seen as an incredible part of the liquidity story. The preparations for these activities already started and an increase for 2021 is predicted.

All the activities described above will help to have healthy balance sheets and first positive cash flows in the first half of 2021 similar to the announcement by Delta. However, the revenue side is still not fully predictable and will be the game changer.

In a nutshell, such operators who will be able to build up most successful cash-burn and liquidity management strategies will be able to survive the crisis and those operators which were able to build up good relationships with banks and other financial institutions will benefit from the access to the capital markets.

Lessors

Compared to the majority of operators, the lessor's ratings remained quite stable. One potential explanation could be the fact, that many lessors are backed up or owned by banks already or they went public in in the last 10 years and therefore they can afford to issue unsecured bonds in order to gain liquidity. Another reason could be, that the business cases of lessors are better understood by the finance community. The private equity capital activities will definitely increase in the aviation industry providing alternative source for airlines and lessors, as we are in a lucrative bottom of the cycle right now. Especially lessors provide a great possibility for private equity firms to enter the aviation sector, therefore it will not be surprising if the leasing model will get another boost in the coming years. Despite these alternative sources and similar to the use case for operators, capital market access for lessors through long term relationships with banks will be a one of great pillars to complete return strategies on the way to recovery.

The sale leasebacks will be part of the equation in order to build up viable fleet portfolios. As discussed in multiple excellent panels during 'The Dublin Dialogues' some big names in the finance market like Goldman-Sachs, Carlyle and Morgan Stanley have confirmed the increase of their activities in the sale leaseback market in support of both sides, the operators and the lessors.

Visible increase of Sale and Lease Back activities during the pandemic

Coming back to the initial question from above: Is there now an increase of SLB within the COVID19 environment?

Yes, indeed. But the pandemic shows that the increase of SLB activities is not only visible within the airline community, which was expected, but also a considered option of several lessors. Even though the airlines concentrate on other activities in order to reduce cost, as described previously, the asset liquidation is a major part of generating unplanned cash without jeopardizing the own operational needs. The trend however is also seen within the lessor community as was analysed by FlightGlobal for example. Since lessors are dealing with lease deferrals as well as early lease terminations, the SLB provides an option to monetise fixed equity without reducing the own portfolio.

In conclusion, an increase of the sale leaseback activities related to aircraft and engine spares was already visible in Q4 2020 (for example Bamboo, Etihad, Vistara or Virgin) and will more likely continue growing under the current environment.

How Aeroji can help?

Aerojis marketplace can support the distribution of those engines effectively. Aeroji strive for transparency of available assets and offers a digital environment for new business connections and distributions worldwide.

Users of Aeroji will be able to oversee the increasing spare engine availability and perform portfolio/fleet optimisations by finding the right asset at the right time. Newly set up features such as Aerojis KPIs and multiple transaction types eases the procedure.

Follow us!

By following our posts, you will get to know the product, follow the development process and be the first to know about newly incorporated features. You can provide your comments and proposals and thereby participate on the continuous improvement of the platform for the benefit of all existing and future users. We would like to establish an interactive relationship with our readers – independent of whether you use the platform or not.

We are there for you anytime to answer all your questions and to listen to all your proposals as well as criticisms. All your feedback is very much appreciated. Just let us know at hello@aeroji.com or on any social network.

Your Aeroji Team